New Delhi:

Most of US President Donald Trump’s most trading partners were widely raised by US President Donald Trump after the surprising U-turn of US President Donald Trump. The US leader on Wednesday announced a 90-day break on the most new tariff on imports in the United States for every country except China.

Trump announced on Wednesday afternoon after the market turmoil, the price of the bond and the US dollar on the first day on the apprehension that the administration’s plans to increase tariffs were seen more than over the last 100 years, pushing the economy into recession.

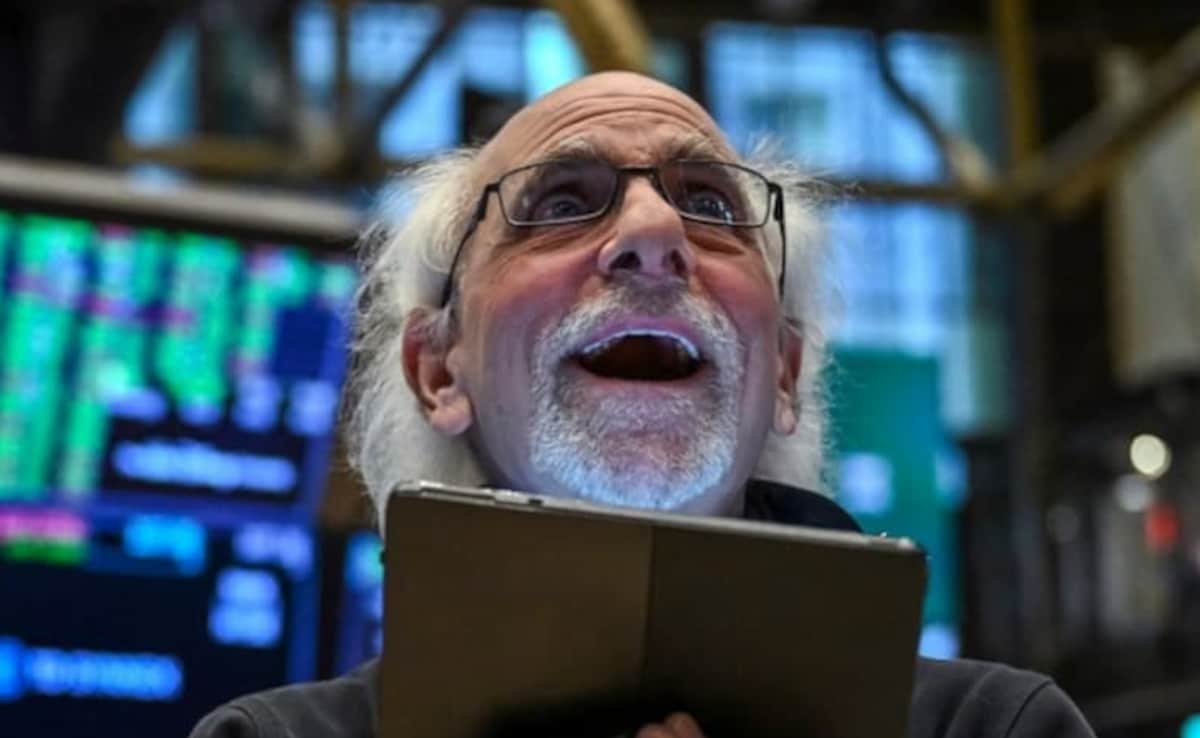

The news of a stagnation gave sudden relief in the market, growing American shares, while markets in the Asia Pacific region also saw a strong rebound in early trade on Thursday.

On Wall Street on Wednesday, the Dow Index increased by about eight percent, while Nasdaq increased by more than 12 percent in 24 years.

According to FactSet, S&P 500 ended its best day 9.5 percent since 2008, which was posting its best day after 2008. The benefit of one day of one day was the third largest since II II II II II II.

Nasdaq has increased by 12.2 percent in its largest one day profit since January 3, 2001 and its second largest part on records. But investors said that there was uncertainty about the long -term plan for tariffs.

In Japan, Nikkei 225 was 8.3 percent up in the morning trade on Thursday, while in Seoul, Kospi was more than five percent. In Australia, ASX 200 jumped more than six percent.

Stocks also increased in Hong Kong, while Shanghai also moved forward as Trump punished Levi up to 125 percent.

The Hang Seng index climbed 2.69 percent, or 545.94 points, 20,810.43, while the Shanghai Composite Index reached 1.29 percent, or 41.03 points, 3,227.84.

Keeping an eye on global markets, Taiwan’s shares increased by 9.2 percent in early trade. Taiiex Index increased by 1,590.79 points to 18,982.55 in the first five minutes of trading, as Taiwanese Tech Giands TSMC increased by 10 percent and Foxconn by 9.8 percent.

In Vietnam, Washington increased by more than 6.5 percent on Thursday after delaying the country’s 46 percent tariff on exports from the country. The main index was 72.41 points soon after opening on Thursday, or 6.62 percent, up to 1,166.71 points.

Indonesia’s benchmark stock index held about five percent more rallies in the open. The Jakarta Composite Index was up to 289.2 points or 4.85 percent to 6,257.18 soon after the market opened on Thursday.

Meanwhile, the Japanese yen was seen as a safe shelter, climbing 0.64 percent against the greenback, 146.83 yen increased to dollars, and gold rose 0.5 percent to $ 3,097 an ounce.

“defining moment ‘

Masayaki Kubota of Rakutane Securities in Japan told news agency AFP that Trump’s announcement was “a wonderful wonder”.

Jeena Bolwin, president of Bolvin Wealth Management Group in Boston, has called the move “an important moment we are waiting for.”

Bolwin told Reuters, “Time may not be better, with the onset of income season.

Since the announcement of Trump’s tariff on 2 April, sales in American assets have been widespread and deep, on Wednesday with Duthe bank analysts stated in a note that “the market had lost confidence in them” and the world was entering the unwanted sector in the global financial system.