NEW DELHI: US President Donald Trump signed an executive order pausing enforcement of a 48-year-old law, Foreign Corrupt Practices Act (FCPA), that prohibits US companies from bribing foreign government officials to get or retain business contracts.

The move could potentially bring relief to Adani Group, which was indicted by the department of justice (DoJ) and US Securities & Exchange Commission (SEC) last year. The order signed by Trump directs attorney general Pam Bondi to pause FCPA actions until revised FCPA enforcement guidance is issued, which “promotes American competitiveness and efficient use of federal law enforcement resources”.

The order said past and existing FCPA actions will be reviewed and future FCPA actions must be approved by the attorney general. TNN

Adani stocks took $55 billion hit after indictment

The order addresses a long-held grievance of the American business that the anti-bribery law leaves them hamstrung vis-a-vis their competitors who don’t have to contend with similar restraint.

The action taken by the US DoJ against billionaire Gautam Adani and his nephew, former executives of Canadian pension fund CDPQ and Azure Power for their alleged role in a $265 million bribery case to secure solar power supply contracts in India, was termed by some quarters as arising out of the FCPA.

The case stoked a massive controversy and led to a significant slide in the group company shares, which have since recovered sharply. The Adani Group had said since the indictment, it had suffered a loss of nearly $55 billion in its market capitalisation across its 11 listed companies. However, in late November, Adani Green Energy Ltd had informed the stock exchanges and clarified that Gautam Adani, Sagar Adani and Vneet Jaain had not been charged with any violation of the FCPA on the counts mentioned in the criminal indictment of the US DoJ or the civil complaint of the US-SEC.

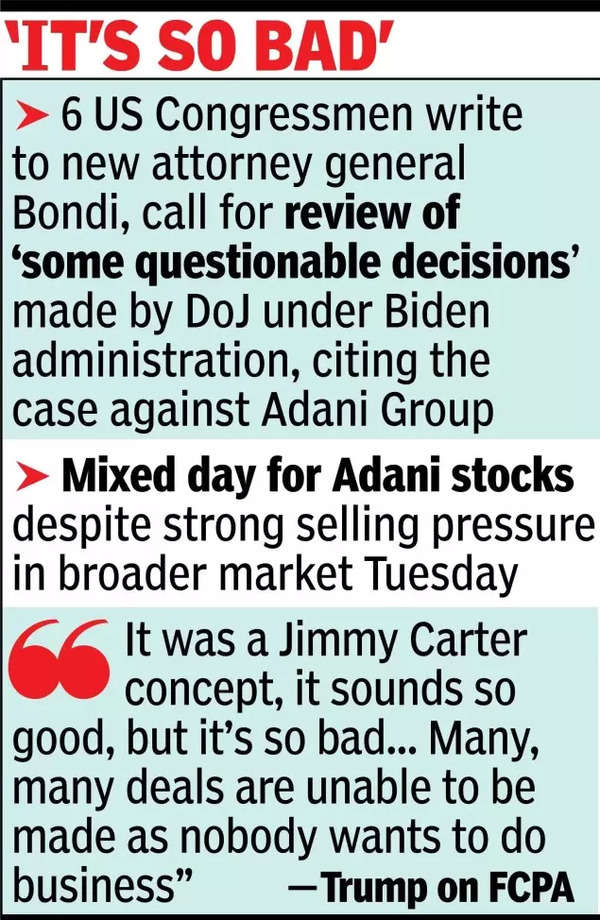

In a significant coincidence, a group of six US Congressmen have written to newly appointed attorney general Bondi, calling for a review of what they said were “some questionable decisions” made by the DoJ under the Biden administration, and cited the case against Adani group.

“One such decision involves the questionable pursuit of a case against the Adani group, an Indian company whose executives are situated in India. The case rests on the allegation that preparations were made by members of this company in India to bribe Indian officials, also exclusively located in India,” said the letter signed by Lance Gooden, Mat Fallon, Mark Haridopolos, Brandon Gill, William R Timmons and Brian Babin.

The letter endorses the grouse of the Adani Group that they were targeted for extraneous considerations and that the DOJ under the Biden administration overplayed its hand. “Instead of deferring the case to appropriate Indian authorities, the Biden DoJ pushed forward and indicted the company’s executives without any real injury to the US interests being present,” said the February 10 letter to Bondi. The Congressmen said there was no compelling reason to pursue a case in a manner that could complicate relations with an ally like India unless some external factors were at play. They said some of these decisions involved pursuing and abandoning cases, often against America’s interest at home and abroad, jeopardising relationships with close allies like India.

On Tuesday, the stocks of Adani group companies had a mixed day despite the broader market witnessing strong selling pressure since the start of the session due to weak global cues. After an initial euphoria about news related to the pausing of the FCPA in the US, the rally across the 11 group stocks fizzled out and only two stocks, group flagship Adani Enterprises and Adani Power, closed higher.

The FCPA of 1977 was enacted for the purpose of making it unlawful for certain classes of persons and entities to make payments to foreign government officials to assist in obtaining or retaining business, according to the DoJ definition. Initially, the US business, reeling under the embarrassment of the Lockheed bribery scam where the American aviation major was accused of bribing the Japanese government for a hefty order, had welcomed the law, saying it would help them with their business. Originally, it applied to only Americans and certain foreign issuers of securities before it was expanded during the Clinton presidency to apply to foreign firms which do business with the US.

The admiration turned to the disappointment and complaint that it had tied their hands against competition and tilted the field in latter’s favour. Trump had promised to change the law in his first term. His order completes what was an important unfinished business.

“It was a Jimmy Carter concept, and it sounds so good, but it’s so bad. It hurts the country and many, many deals are unable to be made because nobody wants to do business,” Trump said, dumping on a recently passed former president whom he disdained, having also blamed him for ceding the Panama Canal to Panama.