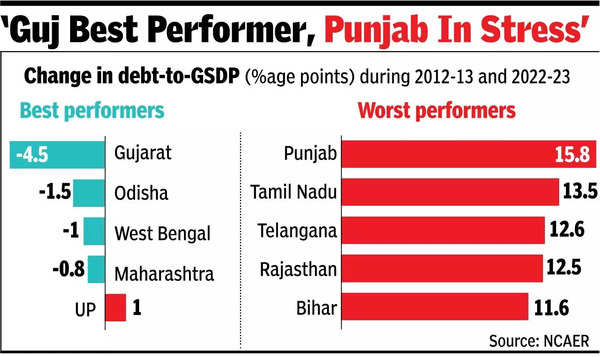

NEW DELHI: Just four states – Gujarat, Odisha, West Bengal and Maharashtra – have managed to lower the debt to gross state domestic product (GSDP) ratio, while Punjab and Tamil Nadu have been the worst performing, seeing the steepest increase, according to a new paper by economists.

The paper by NCAER economist Barry Eichengreen and the agency’s chief Poonam Gupta, who is also part of the advisory council to the 16th Finance Commission, has estimated that Punjab and, possibly, Rajasthan’s debt-GSDP level could cross 50% by 2027-28, underlying the need for focused action.

It has proposed a relook at the role of the Finance Commission itself. “…Finance Commissions have not been asked to consider overall fiscal prudence when recommending allocations. The horizontal devolution (state-wise) of taxes among states… does not provide incentives for fiscal rectitude. Perversely, Finance Commissions are mandated to allocate more resources to states with larger revenue deficits, which is an obvious source of moral hazard and a mechanism through which errant states are subsidised,” it said.

The recommendations come at a time when political parties are doling out freebies and subsidies across states, which already have committed expenditure towards salary and pension and interest payment that are difficult to reduce.

Pointing to the room for a fiscal “grand bargain”, the paper has suggested that heavily indebted states with the worst prospects could be given a modicum of debt relief in return for their conceding additional Central govt oversight and even a temporary dilution of fiscal autonomy.

States account for nearly a third of the overall debt with the Centre accounting for the rest. The paper has advocated the setting up of independent fiscal councils in the states to assess the realism of spending and revenue projections.

Besides, the economists have recommended a forensic analysis identifying the specific revenue shortfalls or expenditure overruns resulting in excessive budget deficits and debt increases in the fiscally worst performing states. They have also said that states need to improve revenue mobilisation through digitalisation and administrative streamlining, by broadening the tax base, raising property tax, and adopting new taxes, and by increasing privatisation receipts while re-orienting spending toward capacity- and infrastructure-enhancing investment.